Expand to British Columbia

New opportunities to diversify internationally await you.

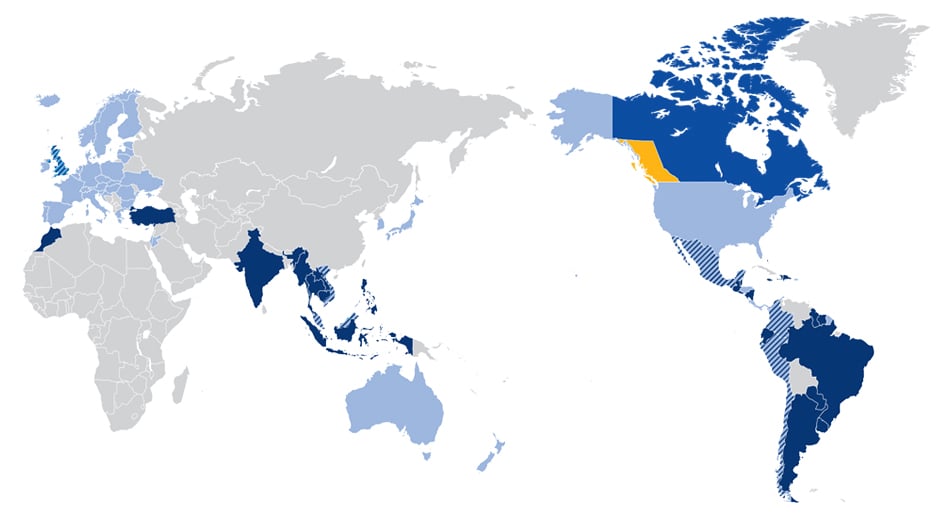

Thanks to a broad trade network, British Columbian companies can benefit from preferential access to markets all over the world. Trade and Invest BC is here to help.

Canada’s Trade Commissioner Service also offers in-depth resources to help apprise you of international markets and covers topics such as tariffs, sanctions, and trade agreements.

Trade Agreements

British Columbian businesses looking to trade with other countries benefit from operating in one of the world’s most open trading economies.

The provincial and federal governments are signatories to interprovincial and international agreements designed to reduce or eliminate barriers to trade for B.C. and Canadian businesses, investors, and workers.

Trade Within Canada

Canadian Free Trade Agreement (CFTA)

The CFTA is an intergovernmental trade agreement between Canada and all provinces and territories. Its objective is to reduce and eliminate, to the extent possible, barriers to the free movement of persons, goods, services, and investments within Canada.

Trade, Investment and Labour Mobility Agreement (TILMA)

TILMA is an agreement between the Governments of British Columbia and Alberta that expands provincial trade and investment opportunities and reduces impediments to trade and labour mobility between the two provinces.

New West Partnership Trade Agreement (NWPTA)

The New West Partnership Trade Agreement (NWPTA) is a trade agreement between British Columbia, Alberta, Saskatchewan, and Manitoba. It covers all domestic trade and creates a single economic region that is the most open and competitive economy in North America.

International Trade

Canada-United States-Mexico Agreement (CUSMA)

CUSMA preserves key elements of the former NAFTA trading relationship and incorporates new and updated provisions that seek to address 21st-century trade issues and promote opportunities for the nearly half a billion people who call North America home.

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is designed to improve access to the Asia-Pacific region, allowing for improved business opportunities based on fair and consistent trade regulations.

Canada-European Union Comprehensive Economic and Trade Agreement (CETA)

CETA has been applied provisionally since 2017 and provides preferential market access to opportunities in the EU. CETA connects B.C. and the rest of Canada with the world’s second-largest trading market for goods.

Tariffs and Other

Requirements

Canada Tariff Finder

Find current tariffs for exporting to and importing from countries that have trade agreements with Canada.

Products may also be subject to export controls or economic sanctions.

Trade Diversification Strategy

Looking for new global opportunities or interested in exporting for the first time? British Columbia’s Trade Diversification Strategy highlights the province’s action plan for supporting businesses to pursue new export opportunities and increasing the number and diversity of B.C. businesses who export.

Key Markets

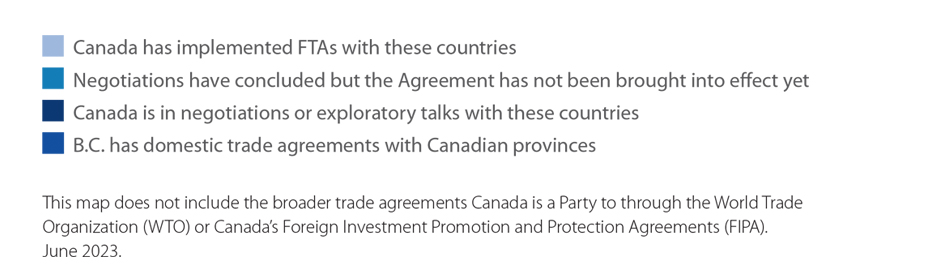

Steps to Claim Preferential

Treatment in FTA Markets

Did you know that importing countries do not automatically apply the preferential tariff rates available to you under free trade agreements? You must first fulfill certain criteria and conditions to claim the benefits at the border.

Step 1

Classify your product

Classify your product using Harmonized System (HS) Code and country-specific digits in just a few clicks. Open Canada’s Tariff Finder website, select a destination country, describe your product (or use the HS code), and then select the product from sub-categories.

Step 2

Does your product meet the FTA rules of origin?

Made in Canada is not the same as Country of Origin. Check the FTA rules of origin to determine how much of the domestic content your goods needs to have to qualify for preferential tariffs under each FTA.

Step 3

Apply for an advanced ruling

Still want more certainty Apply for an advance ruling for tariff or origin classification through the customs agency of the importing country. Contact us or get advice from a freight forwarder or customs broker.

Step 4

You are all set!

You are now ready to benefit from preferential terms of trade! Use the HS Code and rules of origin documentation to claim preferential FTA tariff treatment for your product at the border of the country where the goods are exported.

How We Help

Trade and Invest BC helps build connections between international and B.C. businesses and promote British Columbia’s products and services globally. We have experts located in major trading communities internationally. Contact us to see how we can help you thrive and grow, locally and globally.